Martin Wolf, writing in the Financial Times, touches on a few points that resonate with my readings over the years.

He believes capitalism, as a system, is not a bad one, but it is bad when it is ‘rigged’; and that Aristotle was indeed right (as history has since proved) that a sizeable middle class is necessary for the functioning of a democracy.

We know that the US, for instance, doesn’t really do much about monopolies, having redefined them since the 1980s as essentially OK if no one gets charged more. Hence, Wolf, citing Prof Thomas Philippon’s The Great Reversal, notes that the spikes in M&A activity in the US has weakened competition. I should note that this isn’t the province of “the right”—Philippon also shows that M&A activity reduced under Nixon.

I alluded to the lack of competition driving down innovation, but Wolf adds that it has driven up prices (so much for the US’s stance, since people are being charged more), and resulted in lower investment and lower productivity growth.

In line with some of my recent posts, Wolf says, ‘In the past decade, Amazon, Apple, Facebook, Google, and Microsoft combined have made over 400 acquisitions globally. Dominant companies should not be given a free hand to buy potential rivals. Such market and political power is unacceptable. A refurbishment of competition policy should start from the assumption that mergers and acquisitions need to be properly justified.’

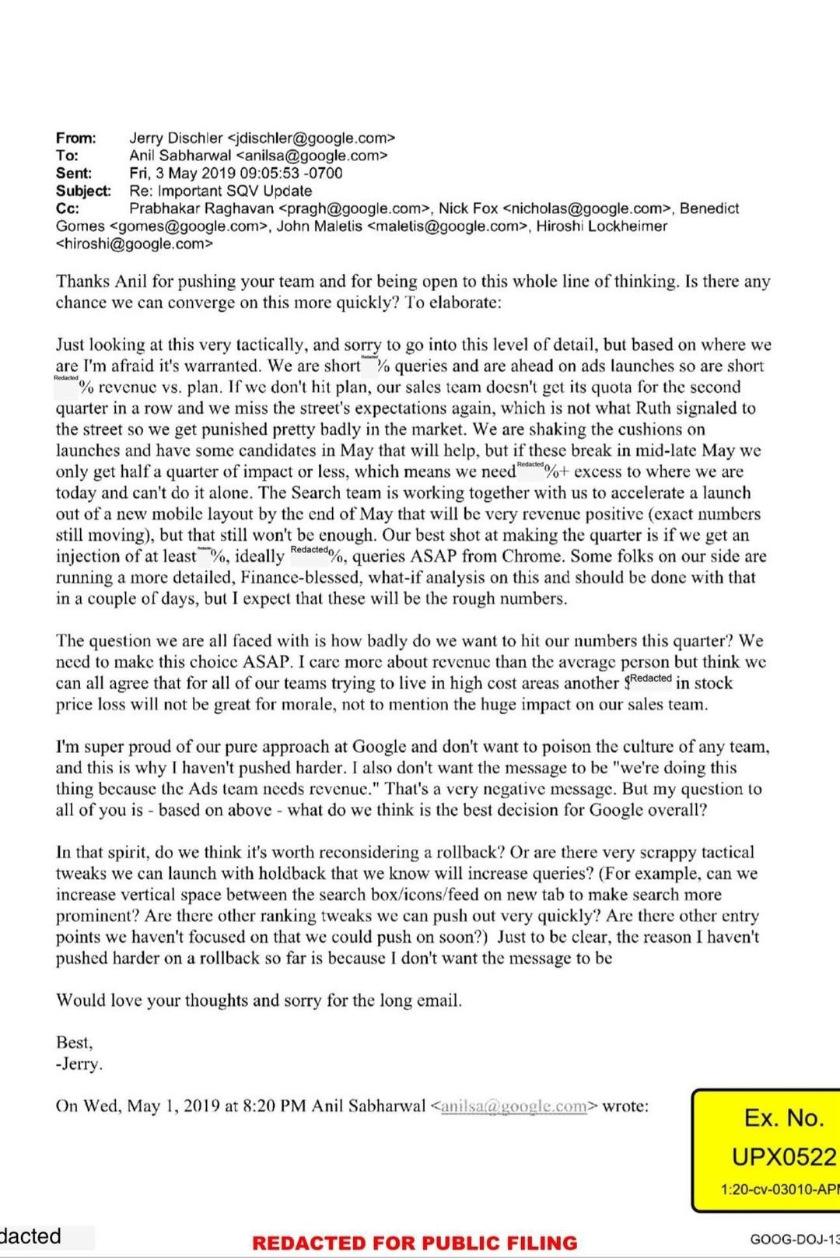

History shows us that Big Tech’s acquisitions have not been healthy to consumers, especially on the privacy front; they colluded to suppress wages before getting busted. In a serious case, according to one company, Google itself commits outright intellectual property theft: ‘Google would solicit a party to share with it highly confidential trade secrets under a non-disclosure agreement, conduct negotiations with the party, then terminate negotiations with the party professing a lack of interest in the party’s technology, followed by the unlawful use of the party’s trade secrets in its business.’ (The case, Attia v. Google, is ongoing, I believe.) Their own Federal Trade Commission said Google ‘used anticompetitive tactics and abused its monopoly power in ways that harmed Internet users and rivals,’ quoting the Murdoch Press. We see many undesirable patterns with other firms there exercising monopoly powers, some of which I’ve detailed on this blog, and so far, only Europe has had the cohones to slap Google with massive fines (in the milliards, since 2017), though other jurisdictions have begun to investigate.

As New Zealand seeks to reexamine its Commerce Act, we need to ensure that we don’t merely parrot the US and UK approach.

Wolf also notes that inequality ‘undermines social mobility; weakens aggregate demand and slows economic growth.’ The central point I’ve made before on Twitter: why would I want people to do poorly when those same people are potentially my customers? It seems to be good capitalism to ensure there’s a healthy base of consumers.