Thanks to my friend Bill Shepherd, I’ve now subscribed to The Ad Contrarian newsletter. Bob Hoffman is one of the few who gets it when it comes to how insignificant the FTC’s Facebook fine is.

Five (American) billion (American) dollars sounds like a lot to you and me, but considering Facebook’s stock rose on the news, they’ve more than covered the fine on the rise alone.

Bob writes: ‘The travesty of this settlement guarantees that no tech company CEO will take consumer privacy or data security seriously. Nothing will change till someone either has to pay personally or go to jail. Paying insignificant fines with corporate money is now an officially established cost of doing business in techland and—who knows?—a jolly good way to boost share prices.’

There’s something very messed up about this scenario, particularly as some of the US’s authorities are constantly being shown up by the EU (over Google’s monopoly actions) and the UK’s Damian Collins, MP (over the questions being asked of Facebook—unlike US politicians’, his aren’t toothless).

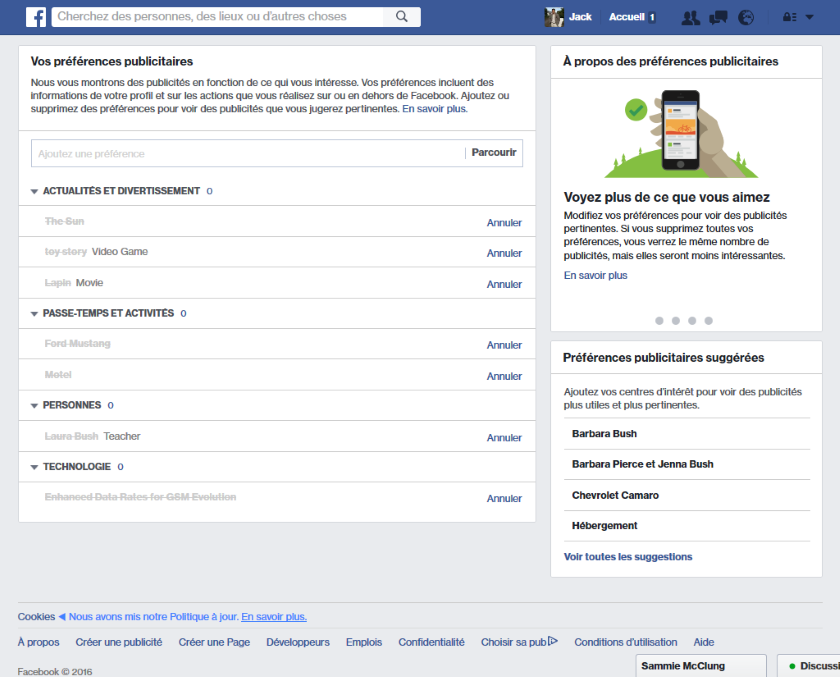

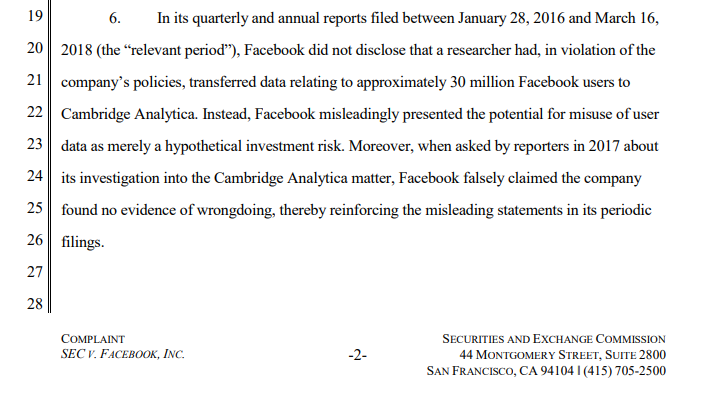

The US SEC, meanwhile, has released its report on Facebook, showing that Facebook knew what was happening with Cambridge Analytica in 2015–16, and that the company willingly sold user data to the firm. SEC’s Stephanie Avakian noted, ‘As alleged in our complaint, Facebook presented the risk of misuse of user data as hypothetical when they knew user data had in fact been misused.’ You can read the entire action as filed by the SEC here.

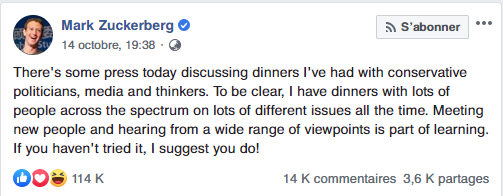

Woah this was 12 days before US elections. Facebook employees knew stuff was going on but their DC office appears to have frozen them. Consumers were deceived and harmed through their personal data likely in order to protect Facebook's reputation and share price. pic.twitter.com/rTpSYptVPG

— Jason Kint (@jason_kint) July 24, 2019

As I have been hashtagging, #Facebooklies. This is standard practice for the firm, as has been evidenced countless times for over a decade. The settlement: US$100 million. Pocket change.