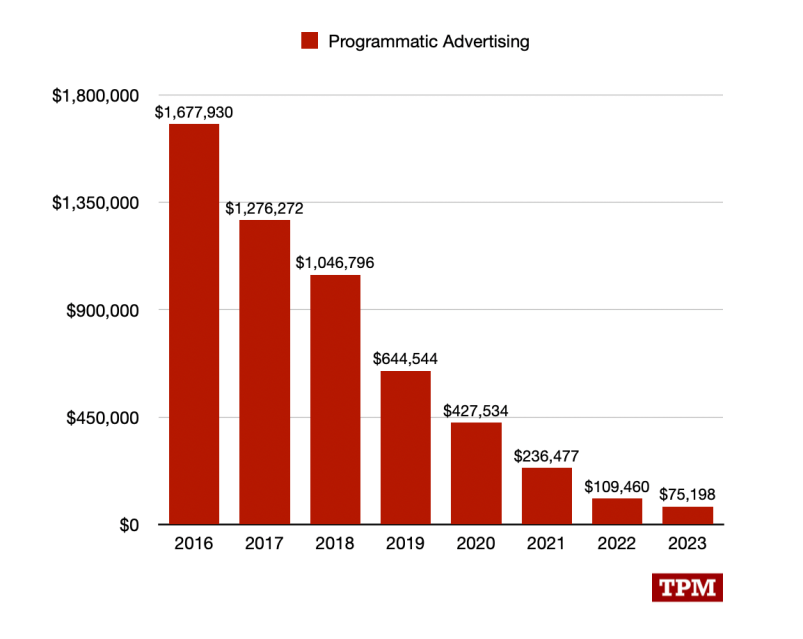

Talking Points Memo showed the amounts programmatic advertising brought in to them over the last eight years. (The above graphic is from their card preview on Mastodon.)

I’ve never been convinced of programmatic since no one in the ad business could ever explain it in plain language. I say just figure out what’s on the page and show something connected to it.

The trend is no surprise, either. We were looking at US$75 CPM in the late 1990s and even some networks could offer double digits. By 2003 it was clear that a tenth of this was the norm, which was one reason I looked at adapting Lucire into a print format for 2004. After Google acquired Doubleclick in 2007, we noticed the ad networks we dealt with begin to falter and disappear, since they could no longer make money. By this point a hundredth of the 1990s price was common, maybe even a thousandth.

If you were relying on online advertising revenue even in the 2000s—forget the 2020s—you were a mug. This isn’t even considering the severe undercounting and the intermediaries taking their cuts everywhere. The only media outlets that resisted this plunge toward zero were your big names like the Financial Times (which I believe still sells around the US$60 CPM mark). For over a decade I told people that the web was an investment, basically a shop window, for our publishing work.

For those reporting the decline of online advertising prices as news (and I’m not referring to TPM here, as they’re making a very valid point with real numbers), you’re 20 to 25 years late.

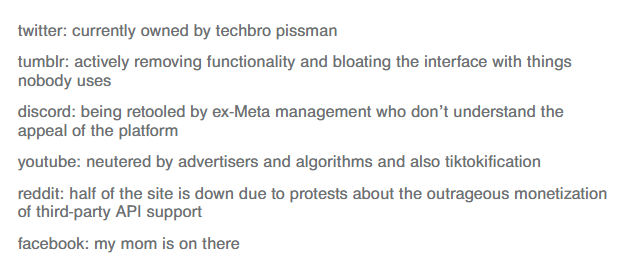

Mike McRoberts, speaking to his ex-wife Paula Penfold in Stuff on the closure of Newshub in New Zealand, has good advice: ‘So if you’re angry about this, I don’t think it’s the media bosses in New Zealand that you need to be angry at. I think it’s go and turn off Google, delete your Facebook account.’